per capita tax bethlehem pa

What is difference between an ACT 511 and ACT 679 Per Capita Tax. Per capita exemption requests can be submitted online.

Per capita tax bethlehem pa.

. Of Transportation ID card. 4225 Easton Avenue Bethlehem Pa. Forms can be picked up at The City of Corry or the Corry Area School District and must be submitted by September 1st to the Corry Area School District Administration Office ATTN.

If both do so it is shared 5050. 6120 Current Per Capita Taxes Section 679 500 500 000 Yes 34 Current Act 511 Taxes Flat Rate Assessments 6141 Current Act 511 Per Capita Taxes 500 500 000 Yes 34. This new tax of 52 is levied on all individuals who engage in an occupation in the Borough of Fountain Hill.

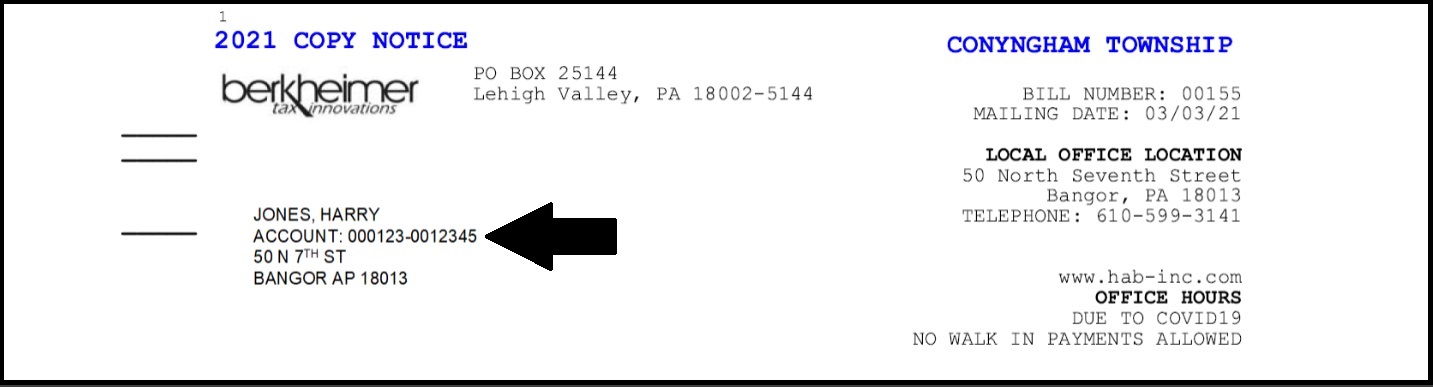

Per Capita 540. PO BOx 519 IrwIn PA 15642 Fax. 1-412-927-3634 Per CAPItA tAx exemPtIOn APPlICAtIOn Name Address Phone Account Invoice SSN Moved Previous address May not exceed 10000 from all sources which includes but is not limited to.

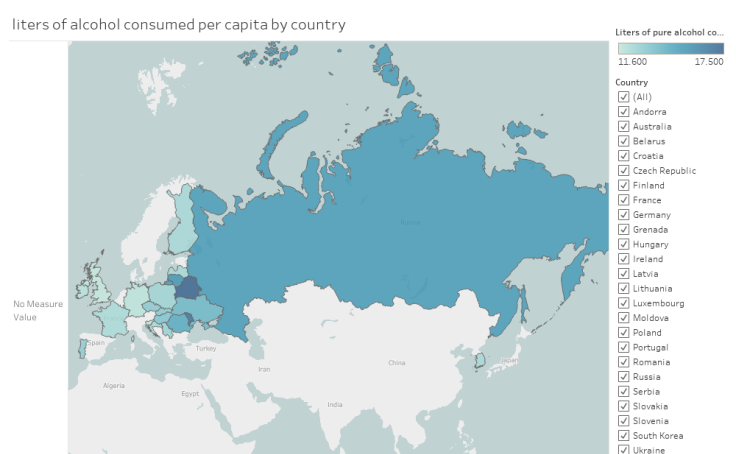

The revenue derived from the tax will be used for police fire and emergency services and for road improvement and maintenance. Graph and download economic data for Per Capita Personal Income in Lehigh County PA PCPI42077 from 1969 to 2020 about Lehigh County PA. Per Capita means by head so this tax is commonly called a head tax.

Box 519 Irwin PA 15642 Irwin PA 15642 All tax bills and payments must be postmarked on or before the dates shown above. Delinquent Real Estate Tax. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000.

Passed 122771 33702 REPORT OF RENTAL UNIT OWNERS. Business Privilege and Mercantile Tax. The tax is due if you are a resident for.

Both taxes are due each year and are not duplications. Northampton Area School District Per Capita Real Estate Taxes are collected by. You must file exemption application each year you receive a tax bill.

ARTICLE 329 Property Tax 32901 Rates 32002 Payment dates. Grove City Tax Office. A 10 fee would generate 372470.

A B C D E F G H I J K L M N O P Q R S T U V W X Y All. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the. Suite A Bethlehem PA 18015.

Also known as the Local Tax Enabling Act. A PA drivers license with current address. 10 Eleanor Drive Spring City PA 19475 Phone.

Act 511 of 1965. Those who make less than 12000 per year are exempted from the Tax. CROSS REFERENCES Power of Council to levy property taxes - See 3rd Class 2531 53 PS.

The City of Bethlehem imposes an amusement tax on all events with a capacity of 200 or more attendees which charge more than 1000 per ticketadmission. A full time student as of July 1 of the tax year. A per capita tax for general revenue purposes at the rate of five dollars 500 per year is hereby levied on all inhabitants of the City about the age of twenty-one years.

The school district as well as the township or borough in which you reside may levy a per capita tax. A flat rate andor proportional tax levied on the occupation of persons residing within the taxing district. ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be.

Local Economic Revitalization Tax Assistance. Bangor Bethlehem Easton Nazareth Northampton Pen Argyl Saucon Valley or Wilson Provide proof of residency dated 90 days before a semester begins with two of the following. Access Keystones e-Pay to get started.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Do I pay this tax if I rent. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

REAL ESTATE TAX PAYMENT PER CAPITA TAX PAYMENT PO. The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber Borough delinquent Per Capita only and Shanksville-Stonycreek School District.

Act 511 Taxes Flat All taxes levied on a flat rate basis in accordance with Act 511 of 1965. It can be levied by a municipality andor school district. In addition amusement event holders must obtain a permit to hold events.

Act 511 Taxes for Pennsylvania School Districts Glossary of Terms. Combined income from wages salary fees pensions. Per Capita Exoneration Change of Address for Tax Billing.

Grants school districts the power to levy certain taxes with maximum rates set by the General Assembly. Keystone Collections Group Black River Plaza 3606 Route 378 Suite A. To insure uniformity all payments must be accompanied by a tax bill in the standard format.

Per capita school district tax receipt for the current year. Exoneration from tax is applicable to the current tax year only. BETHLEHEM AREA SCHOOL DISTRICT Bethlehem Pennsylvania APPLICATION FOR EXONERATION OF PER CAPITA TAX In order to be considered for a temporary exonerationan individual must complete an application on a yearly basis and meet one of the requirements listed below.

Mail Completed Form To. Per Capita Tax Exoneration- residents 66 or over on July 1st of the application year or residents that make less than 1200000 a year can be exonerated from per capita tax. It is not dependent upon employment.

The per capita tax exemption form should be. Portnoff Law Associates 1-866-211-9466 www. 610-495-7667 Collects Township Real Estate Per Capita Tax Tax Certifications may be obtained by submitting a request and payment of 10 per parcel to Missy King at the address above.

Tax Collection Borough Of Bath

Forbes Ranks Bethlehem Pa Top 25 Best Places To Retire City Of Bethlehem City Of Bethlehem

York Adams Tax Bureau Pennsylvania Municipal Taxes

Intestate Distribution To Issue Per Stirpes Per Capita With Representation And Per Capita At Each Generation Per Stirpes Generation Distribution

Per Capita Tax Exemption Form Keystone Collections Group

Poster By Record Section Suburban Resettlement Administration Nypl Digital Collections

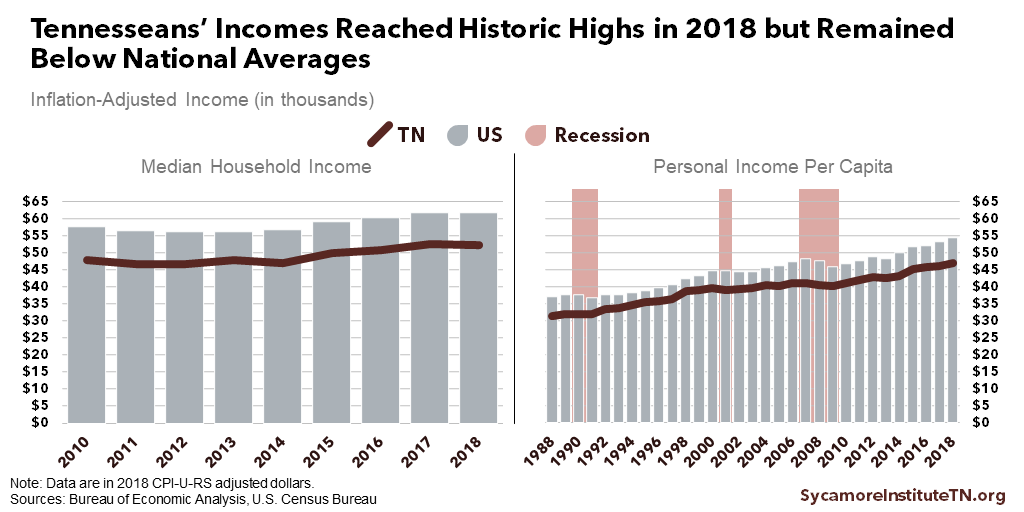

Measuring Prosperity Personal And Household Income In Tennessee

Tennessee Budget Primer The Sycamore Institute

Per Capita And Real Estate Tax Bills Mailed Keystone Collections Group

Information About Per Capita Taxes York Adams Tax Bureau

Saucon Valley School Board Eliminates District S Per Capita Tax Saucon Source

Forbes Ranks Bethlehem Pa Top 25 Best Places To Retire City Of Bethlehem City Of Bethlehem

5 Fiscal Policy The Challenges From Demographic Dynamics And Other Medium Term Developments In The West Bank And Gaza